OCP S.A. successfully completes a 1.75 billion USD bond issuance on the international markets

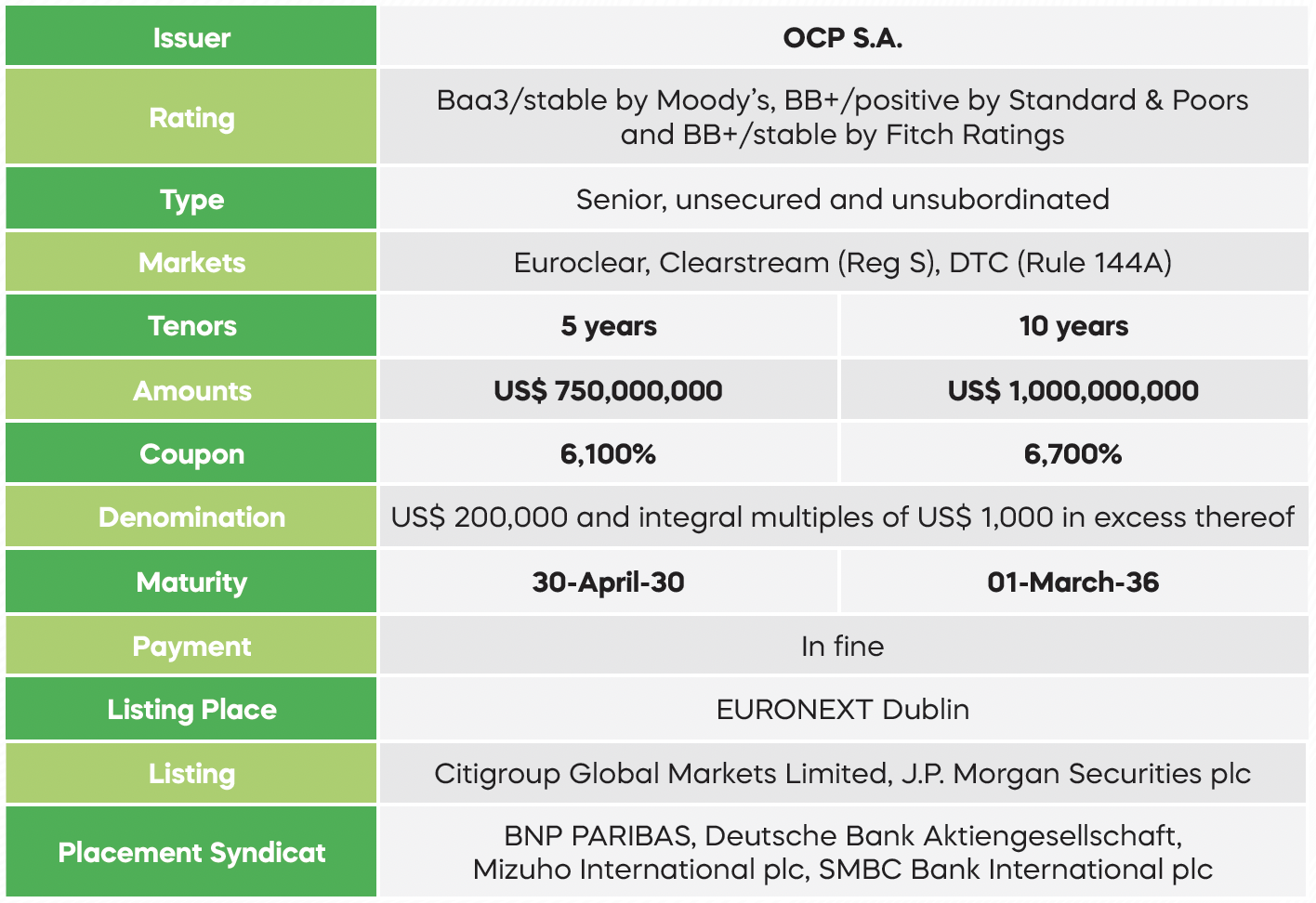

تحميل PDF - 154.48KBFollowing the Board of Directors’ approval of the Eurobond terms on March 11, 2025, OCP SA announced the successful completion of a bond issuance on the international markets for a total amount of 1.75 billion USD. This new issuance is composed of two tranches with maturities of 5 years and long 10 years, for respective amounts of USD 750 million and USD 1 billion, carrying coupons of 6.10% and 6.70%.

OCP intends to allocate the proceeds to the financing of the second phase of its ambitious 2030 investment plan. This plan aims to significantly expand production capacity, increase sustainable investments in water management and renewable energy, and support the development of green ammonia production.

«The success of this bond issuance reflects investors’ continued confidence in OCP’s financial strength and long-term sustainable growth strategy. By seizing a favorable market window following a period of significant volatility since April 2, OCP also marks the reopening of the Eurobond market for emerging market corporate issuers. This transaction further strengthens the Group’s position as a leading global player in the fertilizer industry, backed by strong industrial and financial performance in recent years,» stated Mostafa Terrab, Chairman and CEO of OCP Group.

Transaction key highlights:

- Largest order book ever recorded by OCP.

- The transaction was more than 4 times oversubscribed, with total demand exceeding USD 7 billion across both tranches, enabling significant rate tightening on both maturities.

- Exceptionally competitive new issue premium, limited to 5 basis points (bps) for both tranches — significantly below recent market levels (typically between 20 and 30 bps) — and in line with the level achieved by the Moroccan sovereign in March, despite a more stable market environment at the time.

The bonds are listed on EURONEXT Dublin and are rated (BB + / stable) by Fitch Ratings and (BB + / positive) by Standard & Poors and (Baa3/stable) by Moody’s. The co-lead banks mandated for the issuance and implementation of the liability management transaction are Citigroup Global Markets Limited and J.P. Morgan Securities plco.

The placement syndicate includes BNP Paribas, SMBC, Deutsche Bank, and Mizuho.

OCP was advised on this transaction by Rothschild & Co.

The characteristics of the bond offering are as follows:

These bonds have been offered to qualified institutional buyers, fund managers, banks and private banks in various countries including Morocco, the United States, the United Kingdom, as well as Europe, the Middle East and Asia.

The Prospectus or Offering Memorandum is available on the EUNOEXT Dublin website, as well as the OCP Group’s website at the following link:

https://www.ocpgroup.ma/Capital-Market-Documentation

Contact

• Mrs. Ghita LARAKI

Head of Investor Relations

E-mail : [email protected]