OCP S.A. successfully completed a bond issue on the international markets for 2.0 billion USD.

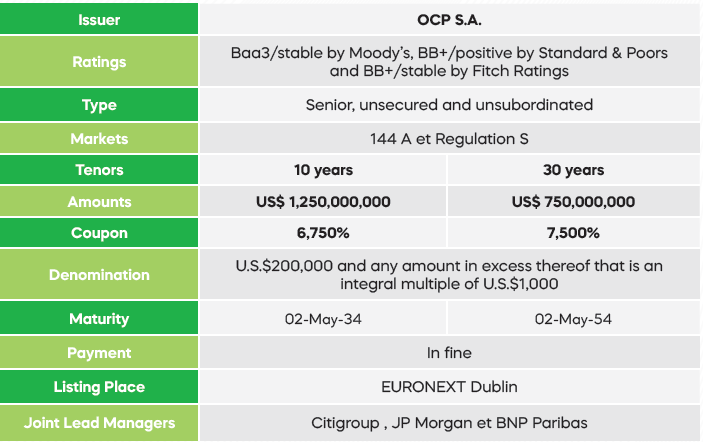

Download PDF - 148.8KBFollowing the Board of Directors’ approval of the Eurobond terms on 24 April 2024, OCP S.A. announced that it had successfully completed a bond issue on the international markets for a total amount of 2.0 billion USD. This new issue is made up of two tranches with maturities of 10 and 30 years, and respective amounts of USD 1.25 billion and USD 750 million, with respective coupons of 6.750% and 7.500%.

OCP plans to allocate the funds raised to finance its Green Investment Program through 2027, aiming to achieve ambitious goals in terms of expanding production capacities, investing in water and renewable energy, as well as producing green ammonia.

« The success of this international bond issue reflects the renewed confidence of investors in the financial strength and sustainable growth vision of OCP, which holds a leading position in the global fertilizer market and has demonstrated strong industrial and financial performance over recent years,» noted Mostafa Terrab Chairman and CEO of OCP.

Transaction key highlights

- Largest transaction ever achieved by the Group.

- The operation was more than 3.1 times oversubscribed, totaling approximately $ 6.2 billion for the two tranches, allowing for a significant tightening of rates for both maturities.

- A negative new issue premium of -5 basis points for the two tranches.

- Historically tight yield spreads on the 10-year and 30-year tranches compared to its previous similar transactions.

The bonds are listed on EURONEXT Dublin and are rated (BB + / stable) by Fitch Ratings and (BB + / positive) by Standard & Poors and (Baa3/stable) by Moody’s.

The co-lead banks mandated for the issuance and implementation of the liability management transaction are Citi, BNP Paribas and J.P. Morgan. OCP was advised on this transaction by Rothschild & Co.

The characteristics of the bond offering are as follows:

These bonds have been offered to qualified institutional buyers, fund managers, banks and private banks in various countries including Morocco, the United States, the United Kingdom, as well as elsewhere in Europe, the Middle East and Asia.

The Prospectus or Offering Memorandum is available on the EUNOEXT Dublin website, as well as the OCP Group’s website at the following link:

https://www.ocpgroup.ma/Capital-Market-Documentation

Contact

• Mrs. Ghita LARAKI

Head of Investor Relations

E-mail : [email protected]